That means it is possible to possible buy a residence or refinance determined by Social Security Positive aspects, as long as you’re at this time obtaining them. Validate your private home obtaining eligibility. Get started right here

His 20+ decades being an editor and writer have included roles in e book publishing, internet marketing, specialized crafting, journey, and personal finance. Lars Peterson joined Investopedia in 2023 just after 4 several years as an editor With all the Stability.

If the value of your private home has fallen since you bought it, you may not even have the capacity to get a house fairness loan or HELOC.

In the event your surviving spouse or partner would not manage to take in excess of the loan, acquiring a mortgage throughout retirement may not be a smart economical choice.

Copies of benefit verification, evidence of revenue or proof of award letter, statements and/or tax returns

A money-in refinance is the alternative of the money-out refinance, as it allows borrowers to put extra money right into a property to make their home equity. Basically, it offers borrowers an opportunity to make A further deposit.

To discover the very best house loan lender for your needs, start out by examining your credit history rating. When you have reasonable credit history or under, taking methods to improve your rating can assist you qualify for cost-effective home finance loan phrases.

Homeowners will nonetheless be chargeable for insurance, home taxes, and upkeep; on the other hand, loan repayment is deferred until the homeowner no more life in the home. Considering the fact that every month mortgage payments will not be essential,three seniors generally use their reverse home loan money as profits tax-free1 funds.

Expense cash may be used to qualify for any home loan. But lenders very likely gained’t rely the complete asset volume. When retirement accounts consist of stocks, bonds, or mutual cash, lenders can only use 70% of the value of People accounts to determine what number of distributions remain.

In case you’re at ease click here earning your home loan payments every month and wish funds for something, a hard cash-out refinance could be useful.

Some specialists stated the most recent trades feature far more protections than crisis-era transactions, such as upfront money prerequisites, which cuts down counterparty risks – a key difficulty during the crisis.

This is especially suitable For a lot of retirees and seniors serious about getting a vacation house, downsizing, or tapping into their house equity. The good thing is, the industry features several different home loan choices for seniors on Social Safety, and here’s what you have to know.

A HELOC is a revolving line of credit that takes advantage of your home’s equity as collateral. Social Security cash flow can be utilized to qualify, but lenders usually demand a very good credit rating score as well as a low debt-to-money ratio. Curiosity prices are typically variable, and You merely pay out interest on the quantity you borrow.

By clicking “Accept All Cookies”, you comply with the storing of cookies in your unit to improve internet site navigation, review site usage, and assist in our internet marketing endeavours.

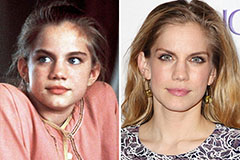

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Daniel Stern Then & Now!

Daniel Stern Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now!